September 2020 Temporary Changes to VAT Rates in Ireland

The standard VAT rate in Ireland has been temporarily reduced from 23% to 21% for the period between the 1st of September 2020 and the 28th of February 2021.

During this change, Animana will ensure that the correct VAT is calculated automatically. As part of this change, the existing ledger names and numbers will be used, with the new percentage values.

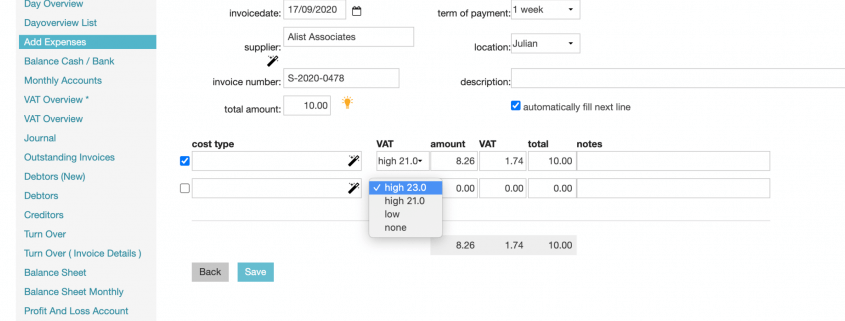

Note that when booking a transaction in the Financial section of Animana you will need to manually select which high rate VAT applies (see screenshot below).

Important notice for clinics who declare VAT based on the payment date.

If your account is currently set up to declare VAT based on the payment date you may see the incorrect VAT shown in the VAT overview section of Animana. This will only happen for a small number of transactions where a payment has been taken after the 1st of September 2020 for an invoice that was raised before the 1st of September 2020. Despite the VAT percentage showing incorrectly, the actual calculation is correct.

If you have any questions please contact Animana Customer Support.

Let’s talk about what IDEXX software can do for your practice

Complete the form below and we’ll get back to you.